Underwriting Discretion

Scheduled Credit/Debit

Most states allow carriers to apply a ‘Scheduled Modification’ to their rating basis. This is a way to provide underwriter discretion, a human element. This deviation is typically 25% in either direction but this does vary based on regulation (TX is +/- 40%).

This presents a carrier with a higher (less competitive) LCM to compete with a more aggressive carrier (lower LCM), or depending on the situation, fend one off. No matter which side you’re on, it always helps to have justification prepared when requesting credit (or begging for debit to be removed). They don’t just give it away like they used to, and they don’t understand your sale so sometimes you have to ask for it, other times demand it.

Standardized Credit Programs

Construction (Contracting) Class Premium Credit Program

Many states have a program available to off-set the higher wages paid (which equates to inflated premium) to Union employees relative to their non-union counterparts. While the credit follows the insured (meaning it applies regardless of carrier), someone has to file for it (you think that septic installer is doing it?). Agents focusing on construction risks tend to have service oriented offices, and (in most situations) should be doing this for their client. As a competitor it is obviously worth investigating, and important that you don’t allude to it directly if you believe the prospect will qualify but does not have one (because they’ll ask their current agent about it, in case you’re wondering).

I’m sure each state has their own variation, but the gist is that they (the rating bureau) set a qualifying hourly rate. To determine qualification the insured’s total payroll for a class of business is divided by those hours worked. If below this rate, they do not qualify. If above, the credit will likely follow a scale based on the deviation from the qualifying rate.

In PA we had to check back periodically because the bureau would only notify the carrier after coverage was bound. Obviously you want to have this represented in your WC rating basis at the time of proposal.

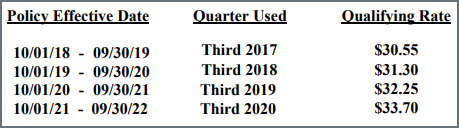

To the right is PA’s qualifying wage, which is based on 3rd quarter payroll (what a crap shoot)..

Managed Care Organization

A WCMCO gives an employer the option to use a managed care system for WC medical care, as opposed to selecting their own, which makes them eligible to receive a premium reduction credit. Not all states offer this, and those that do likely come with some caveats similar to NJ, which states the MCO must be approved by the state bureau, and the carrier must agree, or file to work with the MCO.

In terms of a competitive situation this becomes a factor because if the insured is on board with an MCO and the incumbent offers it, but your market is not on board, you cannot provide the credit.

Safety Committee Certification

Many states offer a certification program for businesses with a safety committee, which entitles them to a premium reduction credit. This takes some effort, there needs to be a justifiable amount of revenue to take on the responsibility. Assuming the size is there, handling the application process is a great value-add in addition to participation.